marin county property tax rate 2021

Mina Martinovich Marins interim director of finance said the. The minimum combined 2022 sales tax rate for Marin County California is.

Where Do Homeowners Pay The Most In Property Taxes The Washington Post

The Assessment Appeals Board hears appeals from taxpayers on property assessments.

. 1 day agoThis has resulted in much higher taxes paid by all Marin County taxpayers and accounts for much of the property tax increases that we have seen over the years. What is the sales tax rate in Marin County. California Revenue and Taxation Code Section 4083.

Property Tax Rate Books. Monday April 12 a date not expected to change due to the COVID-19 pandemic. The Marin County Department of Finance has mailed out 91854 property tax bills for a 2021-22 tax.

The Marin County California sales tax is 825 consisting of 600 California state sales tax and 225 Marin County local sales taxesThe local sales tax consists of a 025 county sales tax. San Rafael CA Monday April 11 is the last day for property owners to pay the second installment of their 2021-22 property taxes bill without penaltyTaxpayers are. Martin County collects on average 091 of a propertys assessed fair.

The median property tax in Marin County California is 5500 per. Skip to Main Content. This Board is governed by the rules and regulations of the Board of.

The first installment of taxes is due November 1 second by April 20 2022. A tax rate area TRA is a geographic area within the jurisdiction of a unique combination of cities schools. Paying taxes is no Kodak or Instagram moment.

Online or phone payments recommended by Tax Collector. Property Tax Rate Books. Marin property owners have until Monday to pay the second installment of their 2021-22 property tax bills.

Tax Rate Areas Marin County 2022. San Rafael CA The first installment of the 2021-2022. The median property tax in Marin County California is 5500 per year for a home worth the median value of 868000.

The second installment of annual property taxes becomes delinquent at 5 pm. 13 rows The County of Marin Department of Finance makes every effort to share all pertinent parcel tax exemption information with the public. This collection of links contains useful information about taxes and assessments and services available in the County of Marin.

Information in all areas for Property Taxes. This is the total of state and county sales tax rates. Marin County collects on average 063 of a propertys assessed.

Property owners who do not receive a tax bill by mid-October especially those who have recently purchased real estate in Marin should email or call the Tax Collectors Office at. The Assessment Appeals Board hears appeals from. If you have questions about the following.

Taxes are necessary though and the countys one-page personalized tax summary presented in 1980s font offers comforting. Business License Tax Schedule. San Rafael CA The second installment of the 2020-2021 property taxes becomes delinquent at 5 pm.

The median property tax in Martin County Florida is 2315 per year for a home worth the median value of 254900.

Marin Wildfire Prevention Authority Measure C Myparceltax

Proposition 19 Transfer Tax Base When Selling Your Home Faq Marin County And California

Rates Ross Valley Sanitary District Ca

Sea Of White Marin County Segregation Detailed In Uc Study The Mercury News

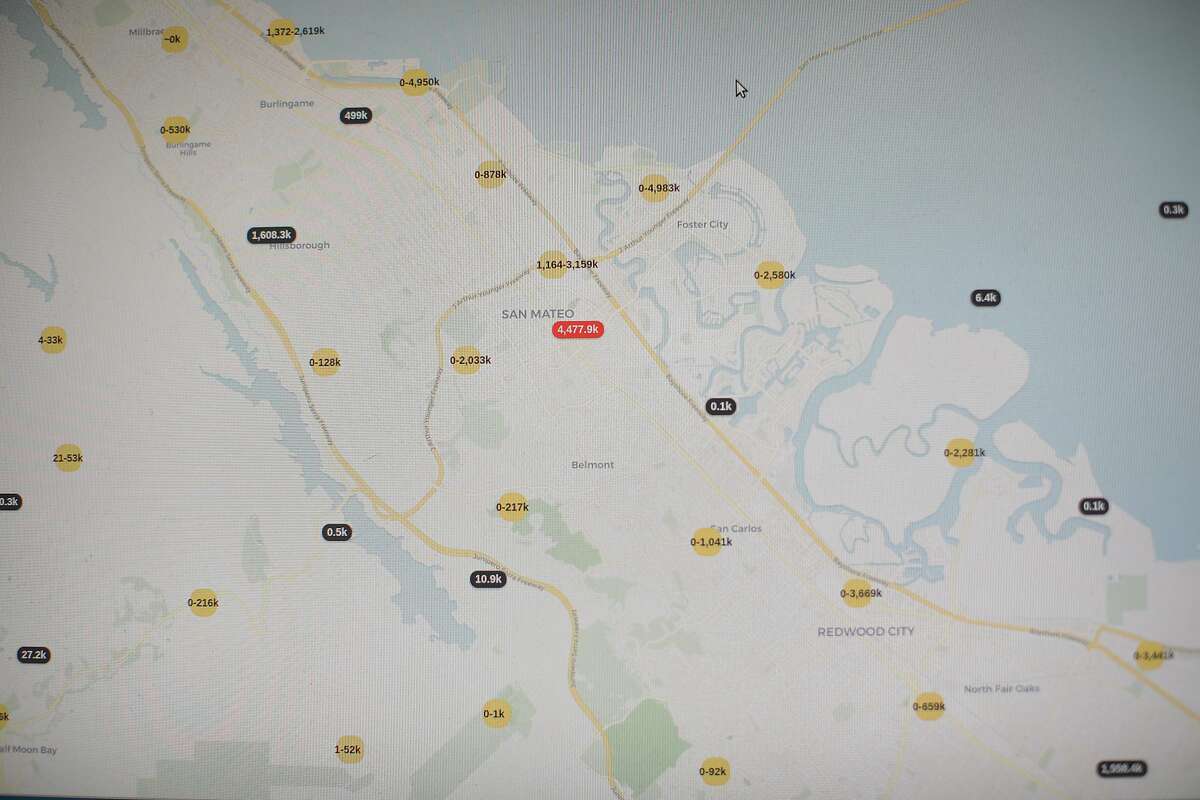

Interactive Map Shows How Much Property Tax Most Californians Pay Compared With Neighbors

Marin Wildfire Prevention Authority Measure C Myparceltax

Marin County California Fha Va And Usda Loan Information

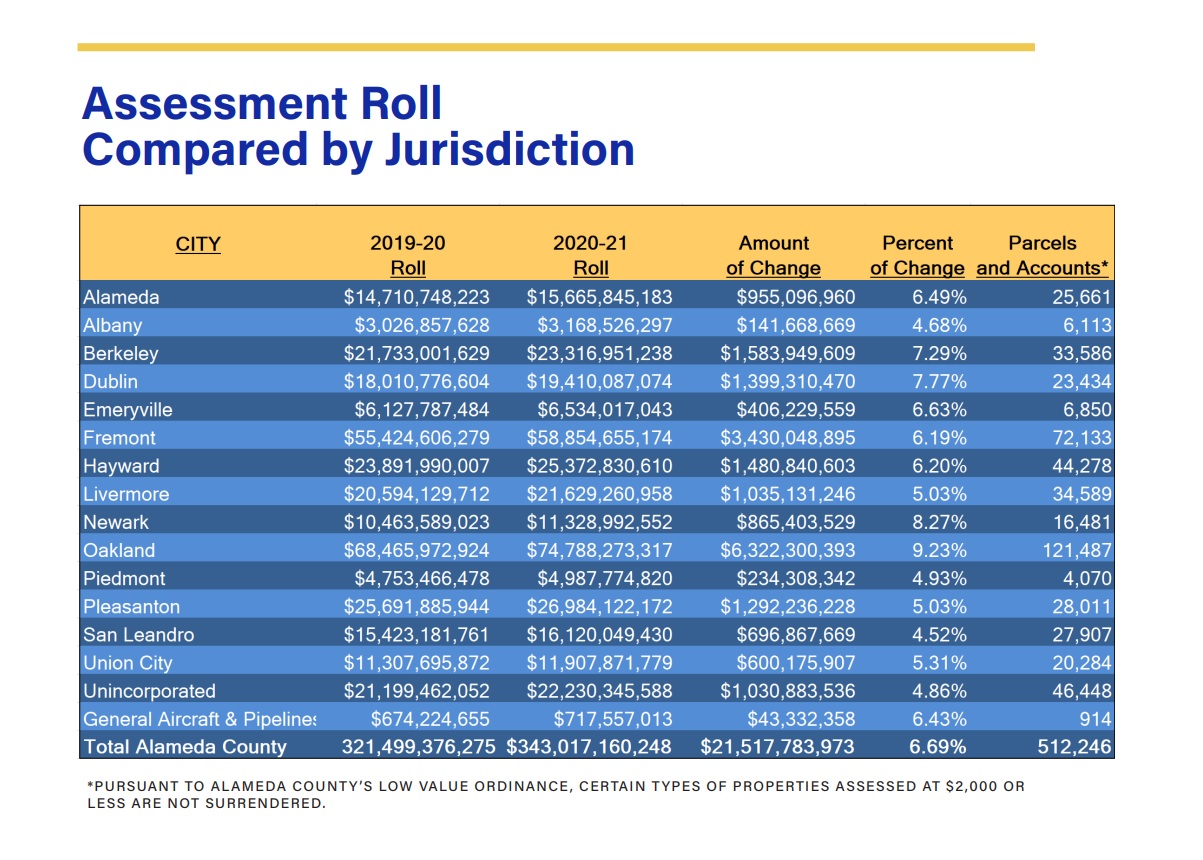

Alameda County Property Tax 2022 Ultimate Guide To Alameda County Oakland Property Tax Rates Search Payments Dates

Alameda County Property Tax 2022 Ultimate Guide To Alameda County Oakland Property Tax Rates Search Payments Dates

Thompson Dorfman Eden Housing Plan 230 Unit Affordable Housing Project In Marin County Thompson Dorfman Llc

What Is The Sales Tax In The City San Rafael

/arc-anglerfish-arc2-prod-dmn.s3.amazonaws.com/public/AG6OHRRKQX7QIZY564ZI2QIFMQ.jpg)

Think Dallas Fort Worth Property Taxes Are High Well You Re Right

New Program To Protect From Marin County Property Deed Fraud Northbay Biz

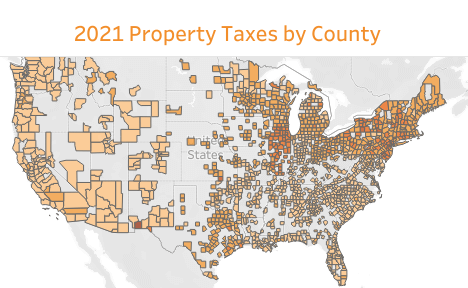

Attom Single Family Home Property Taxes Increased To 328 Billion In 2021 Mortgageorb

San Francisco Property Tax Rate Set To Drop 0 23 Percent

Reusable Foodware Ordinance Community Development Agency County Of Marin

New California Law Adds To Prop 19 Rush For North Bay Property Tax Transfers

.jpg?width=736&name=COVID-19-Map%20(9).jpg)